Tapping a card or smartphone on a POS terminal to pay for a coffee has become a daily, almost automatic gesture. This simple action, which combines speed and innovation, is made possible by Near Field Communication (NFC) technology. In a country like Italy, where the tradition of cash is deeply rooted, the adoption of contactless payments represents a fascinating meeting point between established habits and new digital frontiers. This technology not only simplifies transactions but redefines our relationship with money, making it faster, safer, and more hygienic.

The shift to electronic payments is an unstoppable trend across Europe, but in Italy, it takes on particular nuances. Mediterranean culture, often tied to tangible forms of payment, is progressively embracing the benefits of digital. According to data from the Innovative Payments Observatory of the Polytechnic University of Milan, for the first time in 2024, digital payments in Italy surpassed cash, reaching 481 billion euros. This epochal change is largely driven by contactless payments, which now constitute almost 90% of electronic transactions in stores. A clear signal of how innovation can successfully integrate into the cultural and social fabric.

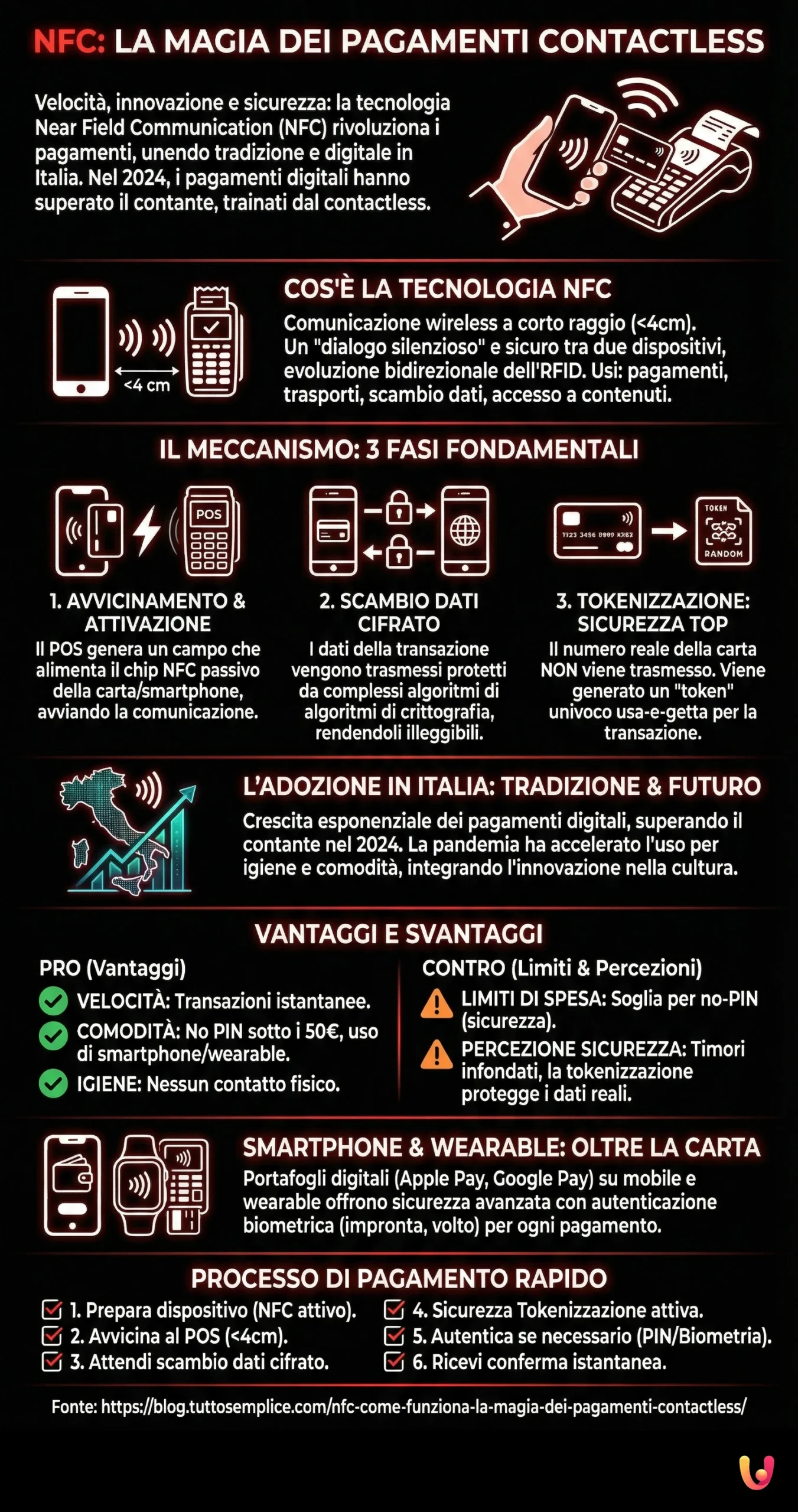

What NFC Technology Is and How It Originated

The acronym NFC stands for Near Field Communication. It is a short-range wireless transmission technology that allows two devices to exchange data when they are at a very close distance, generally not exceeding 4 centimeters. Imagine it as a silent and instant dialogue: as soon as the two devices are close enough, they begin to communicate securely without the need for cables or internet connections. This technology is a direct evolution of RFID (Radio-Frequency Identification), but with a fundamental difference: while RFID is often unidirectional, NFC allows two-way communication.

Its most well-known application is undoubtedly linked to contactless payments, but its potential is much broader. It is used to validate public transport tickets, exchange contacts between smartphones, pair Bluetooth headphones, or even access interactive digital content via special “tags”. Its strength lies in the combination of ease of use and intrinsic security, provided precisely by the need for physical proximity, which makes data interception by malicious actors much more difficult.

The Mechanism of Contactless Payments Explained Step by Step

The contactless payment process may seem magical, but it relies on precise and secure technological principles. Everything happens in a matter of seconds through an invisible interaction between your card (or smartphone) and the merchant’s payment terminal, known as a POS (Point of Sale). This process consists of three fundamental phases that guarantee speed and high standards of protection for sensitive data.

The Approach: The Beginning of Communication

The first phase is the physical action of bringing the payment device close to the reader. The POS terminal is an active device, meaning it constantly generates a weak radio frequency field. The payment card or smartphone, on the other hand, contains an NFC chip that acts as a passive device, lacking its own power supply. When the card enters the range of the POS, the electromagnetic field instantly powers it, “waking up” the chip and starting the communication for the transaction. This interaction can only occur at a minimum distance, making the system inherently secure.

Data Exchange: A Silent and Encrypted Dialogue

Once the connection is established, the actual exchange of information begins. The data necessary for the transaction, such as the amount and payment details, are transmitted between the two devices. This “dialogue” does not happen in plain text. On the contrary, all information is protected by complex encryption algorithms. Encryption transforms sensitive data into a code unreadable to anyone without the correct decoding key, ensuring that, even in the case of interception, the information remains protected and incomprehensible.

Tokenization: The Secret to Security

Here comes the most important security element: tokenization. During a contactless payment, your real credit card number is never transmitted to the POS terminal. Instead, a “token” is generated, which is a unique and random numeric code valid exclusively for that single transaction. This token replaces the sensitive card information. If a malicious actor managed to intercept this code, it would be completely useless, as it contains no real account data and cannot be reused for other operations. This mechanism represents a fundamental level of protection, especially when using digital wallets like Apple Pay or Google Pay.

The Adoption of NFC Payments in Italy: Between Tradition and Future

Italy presents a fascinating picture regarding the adoption of digital payments. While there is a strong cultural attachment to cash, there is also exponential growth in the use of electronic tools. This dualism between tradition and innovation is finding a balance precisely thanks to the simplicity and security offered by NFC technology. Data shows that Italy, despite starting from lower adoption rates compared to Northern European countries, is growing at a faster pace. The convenience of paying for a coffee or a newspaper with a simple gesture is winning over consumers and small merchants who were historically more reluctant.

The pandemic certainly accelerated this process, highlighting the hygienic benefits of contactless payments. However, the trend was already underway, driven by the spread of smartphones and increasing familiarity with digital technologies. Today, seeing the contactless symbol with its four increasing waves has become the norm in most shops, from large supermarkets to neighborhood stores. This change is not just technological but cultural, demonstrating how even a society with strong traditional roots can embrace the future of payments, finding a new way to manage daily finances.

Pros and Cons of NFC Payment

Like any technology, NFC-based payments have a set of pros and cons that are useful to know. Their growing popularity is due to tangible benefits in the daily shopping experience, but it is equally important to be aware of limits and common concerns, often linked to a misconception of security.

The Pros: Speed, Convenience, and Hygiene

The most obvious advantage is speed. A contactless transaction is completed in a few moments, drastically reducing waiting times at the checkout. Added to this is convenience: for amounts below a certain threshold (usually 50 euros in many European countries), it is not necessary to enter the PIN, further simplifying the operation. Furthermore, the ability to pay via smartphone or smartwatch, using services like Google Pay or Apple Pay, allows you to leave home without a wallet. Finally, an aspect that has become crucial in recent years is hygiene: by not having to handle cash or insert the card into the terminal, contact with surfaces touched by others is limited.

The Cons: Spending Limits and Perception of Security

One of the perceived disadvantages is the spending limit for transactions without a PIN. Although this limit is designed as a security measure, it can be inconvenient for larger purchases. However, simply entering the code is enough to authorize higher payments. The main concern for many users regards security. The fear that a malicious actor could “steal” card data simply by getting close with a reader is widespread but unfounded. As explained, NFC technology requires a minimum distance and, above all, tokenization prevents the transmission of real card data, making transactions extremely secure. Another precaution is to avoid using public Wi-Fi networks for transactions, preferring secure connections.

Beyond Credit Cards: NFC on Smartphones and Wearables

The true revolution of NFC did not stop at physical payment cards but found its maximum expression in the devices we always carry with us: smartphones and wearables. Platforms like Apple Pay, Google Pay, and Samsung Pay have transformed mobile phones and smartwatches into real digital wallets, adding further levels of convenience and security. These services allow you to digitize your cards, such as a Postepay Evolution, and use them to pay in stores exactly as you would with the physical card.

The main advantage of mobile payments lies in advanced security. To authorize a transaction, in fact, it is not enough to bring the device close to the POS, but biometric authentication (fingerprint or facial recognition) or entering the phone’s unlock code is required. This means that even in the event of theft or loss of the smartphone, no one could make unauthorized payments. Furthermore, digital wallets offer the convenience of managing multiple cards from a single application and receiving instant notifications for every transaction, ensuring total control over one’s expenses. The use of wearable devices, such as smartwatches, takes convenience to a higher level, allowing payment with a simple flick of the wrist, ideal during sports activities or when your hands are full.

- Prepare the payment device

Make sure you have a contactless card or a smartphone with active NFC and a configured wallet, such as Google Pay or Apple Pay, ready for use.

- Bring the device close to the POS

Position the card or phone at a distance of less than 4 cm from the contactless symbol on the POS terminal to activate the wireless connection.

- Wait for the encrypted data exchange

Hold the position for a few moments while the devices communicate. Transaction data is transmitted protected by advanced encryption.

- Leverage the security of Tokenization

The system generates a unique code called a ‘token’ instead of real card data, ensuring that your sensitive information is never exposed.

- Authenticate the transaction if necessary

For amounts over €50 or on mobile, authorize the payment via PIN, fingerprint, or facial recognition to unlock the operation.

- Receive payment confirmation

Wait for the acoustic or visual signal from the POS. The transaction concludes in a few seconds, offering a fast, hygienic, and secure payment method.

In Brief (TL;DR)

Near Field Communication (NFC) technology is the heart of contactless payments and allows for secure and fast data exchange between the payment card or smartphone and the POS terminal.

Discover the technical principles that guarantee a rapid and protected transaction, simply by bringing your card or smartphone close to the POS terminal.

A technology that transforms simple proximity into a secure and immediate transaction.

Conclusions

NFC technology has silently revolutionized the world of payments, transforming a complex gesture into a simple, rapid, and secure action. Its success, especially in a context like the Italian and European one, demonstrates how innovation can effectively integrate into daily habits, even the most deeply rooted ones. Thanks to advanced security mechanisms like encryption and tokenization, contactless payments offer a superior level of protection compared to traditional methods, dispelling false myths about their alleged vulnerability. The adoption of this technology via smartphones and wearable devices is not just a passing fad but represents a concrete step towards a future where financial transactions will be increasingly dematerialized, integrated, and secure. For anyone who loves to stay informed about the practical aspects of life, understanding how NFC works means not only appreciating a convenience but also gaining awareness of a tool that is shaping the present and future of commerce.

Frequently Asked Questions

Yes, NFC payments are extremely secure due to advanced technologies like encryption and tokenization. When you pay, your actual card number is not transmitted; instead, a unique random code known as a token is used for that specific transaction. This ensures that even if the data were intercepted, it would be useless to a hacker as it contains no sensitive banking information.

This is a widespread myth, but the risk is virtually non-existent. NFC technology requires the devices to be very close, typically less than 4 centimeters apart, making accidental connections unlikely. Furthermore, because the system uses tokenization, a thief scanning your pocket would only obtain a one-time code that cannot be reused for other transactions, rendering the effort futile.

No, you do not need a PIN for every purchase. For small amounts, generally under 50 euros in many European countries, the transaction is authorized immediately by tapping the card or phone. However, for security reasons, once the purchase amount exceeds this set threshold, the terminal will require you to enter your PIN or verify your identity via biometrics on your smartphone.

Using a smartphone or smartwatch adds an extra layer of security compared to a plastic card. Mobile wallets like Google Pay or Apple Pay require biometric authentication, such as a fingerprint or facial recognition, or a passcode to authorize the payment. This means that even if your phone is lost or stolen, a thief cannot use it to make purchases without your unique biological data.

The process relies on magnetic induction. The POS terminal constantly emits a weak electromagnetic field. When your passive card enters this field, the chip inside is powered up instantly, allowing it to wake up and communicate with the terminal. They then exchange encrypted data to complete the transaction in a matter of seconds without needing a direct internet connection for the card itself.

Still have doubts about NFC: How the Magic of Contactless Payments Works?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.