Do you want to discover a simple, secure, and flexible way to manage your expenses, without the worries of a traditional credit card? The PayPal Prepaid Card, issued in partnership with Lottomaticard, could be the ideal solution for you. Whether you are an online shopping lover or prefer contactless payments in stores, this card offers you the freedom to spend only the money you have loaded, always keeping control of your budget. Continue reading to discover everything there is to know about the PayPal Prepaid Card, from its advantages to costs, up to user opinions.

What is the PayPal Prepaid Card?

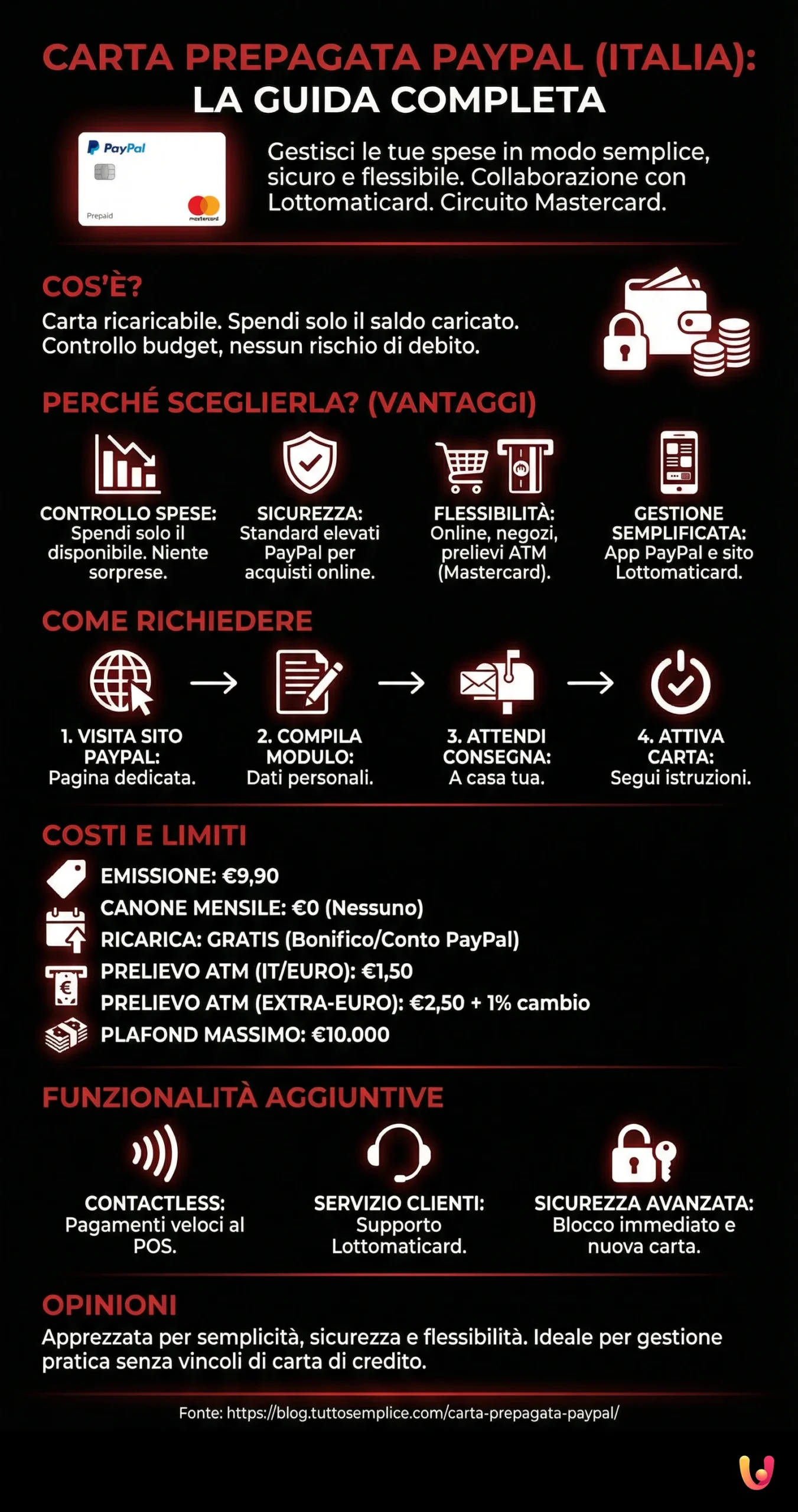

The PayPal Prepaid Card is a reloadable card that allows you to make purchases in Italy and around the world, wherever the Mastercard network is accepted. Unlike credit cards, with the PayPal Prepaid Card you only spend the money you have loaded onto the card, thus avoiding the risk of going into debt and helping you manage your budget responsibly.

Why Choose the PayPal Prepaid Card?

The PayPal Prepaid Card offers several advantages:

- Expense control: Spend only the available balance, avoiding surprises at the end of the month.

- Security: Make online purchases with complete peace of mind thanks to PayPal‘s high security standards.

- Flexibility: Ideal for online purchases, in-store payments, and cash withdrawals at ATM counters.

- Simplified management: Check your card balance and movements via the PayPal app or the Lottomaticard website.

How to Request the PayPal Prepaid Card

Requesting the PayPal Prepaid Card is simple:

- Visit the PayPal website: Go to the page dedicated to the PayPal Prepaid Card on the official PayPal website.

- Fill out the application form: Enter your personal data and the required information.

- Wait for card delivery: You will receive the card directly at your home.

- Activate the card: Follow the instructions provided to activate your card and start using it.

Costs and Limits

The PayPal Prepaid Card involves some costs and usage limits:

- Issuance cost: The card issuance cost is 9.90 euros.

- Monthly fee: There is no monthly fee.

- Top-up fees: Topping up the card is free if done via bank transfer or PayPal account.

- Withdrawal fees: For cash withdrawals at ATM counters in Italy and the Eurozone, there is a 1.50 euro fee, while for withdrawals in foreign currency, the fee is 2.50 euros, plus a 1% commission on the exchange rate.

Regarding usage limits, the card has a maximum balance cap of 10,000 euros.

Additional Features

In addition to basic functions, the PayPal Prepaid Card offers some additional features:

- Contactless technology: Make fast and secure payments by bringing the card close to the POS.

- Dedicated customer service: Contact Lottomaticard customer service for any questions or assistance.

- Advanced security: In case of theft or loss, you can block the card immediately and request a new one.

Opinions and Reviews on the PayPal Prepaid Card

The PayPal Prepaid Card is generally appreciated by users for its simplicity, security, and flexibility. It is an ideal solution for those looking for a practical way to manage their expenses, make online purchases, and withdraw cash, without the constraints of a traditional credit card.

In Brief (TL;DR)

The PayPal Prepaid Card is a reloadable card issued in partnership with Lottomaticard, offering a simple and secure way to manage your expenses.

You can use it for online and in-store purchases, withdraw cash, and check your balance via the PayPal app or the Lottomaticard website.

The card is contactless and allows you to keep your expenses under control, spending only the available balance. Furthermore, it offers the security and reliability of the PayPal brand.

Conclusions

The PayPal Prepaid Card, issued in partnership with Lottomaticard, presents itself as an interesting solution for those who want a simple and secure prepaid card, with the support of an internationally recognized brand like PayPal. The card offers the flexibility to make purchases online and in physical stores, withdraw cash from ATMs, and manage one’s finances responsibly, avoiding excessive spending.

However, before requesting the PayPal Prepaid Card, it is fundamental to carefully evaluate your needs and consider some aspects. First of all, it is important to keep in mind the costs associated with the card, such as the issuance cost and fees for cash withdrawals. Furthermore, it is necessary to consider the usage limits, such as the maximum balance cap of 10,000 euros.

Ultimately, the PayPal Prepaid Card can be a valid choice for those looking for a practical and versatile payment solution, but it is advisable to compare its features with those of other prepaid cards available on the market to identify the one best suited to your needs and lifestyle.

Frequently Asked Questions

The PayPal Prepaid Card is a reloadable card issued by PayPal in partnership with Lottomaticard. It allows you to make purchases online and in stores, wherever Mastercard is accepted.

It has an issuance cost of 9.90 euros. There are no monthly fees.

You can top it up via bank transfer, from your PayPal account, or at Lottomatica LIS CARD points of sale.

The maximum balance cap is 10,000 euros. Daily limits for withdrawals and payments apply.

Yes, you can use it for purchases and withdrawals worldwide, wherever Mastercard is accepted.

Yes, it offers high security standards to protect your funds and transactions.

Contact Lottomaticard customer service immediately to block it and request a new card.

Yes, you can withdraw cash at ATM counters.

You can visit the PayPal or Lottomaticard website for more information.

Still have doubts about PayPal Prepaid Card (Italy): The Complete Guide?

Type your specific question here to instantly find the official reply from Google.

Sources and Further Reading

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.