Do you own a Postal Passbook and are wondering if the associated Libretto Card allows you to make purchases in stores? Or perhaps you simply want to better understand how this tool works and what its benefits are? You are in the right place! In this complete guide, we will explore the Postal Passbook Card in depth, analyzing its features, limits, and answering the crucial question: can it actually be used to pay in stores? Together we will discover how to withdraw cash, deposit money, and best manage your Postal Savings Book, making the most of the Libretto Card. Continue reading to find out everything you need to know!

What is the Postal Passbook Card?

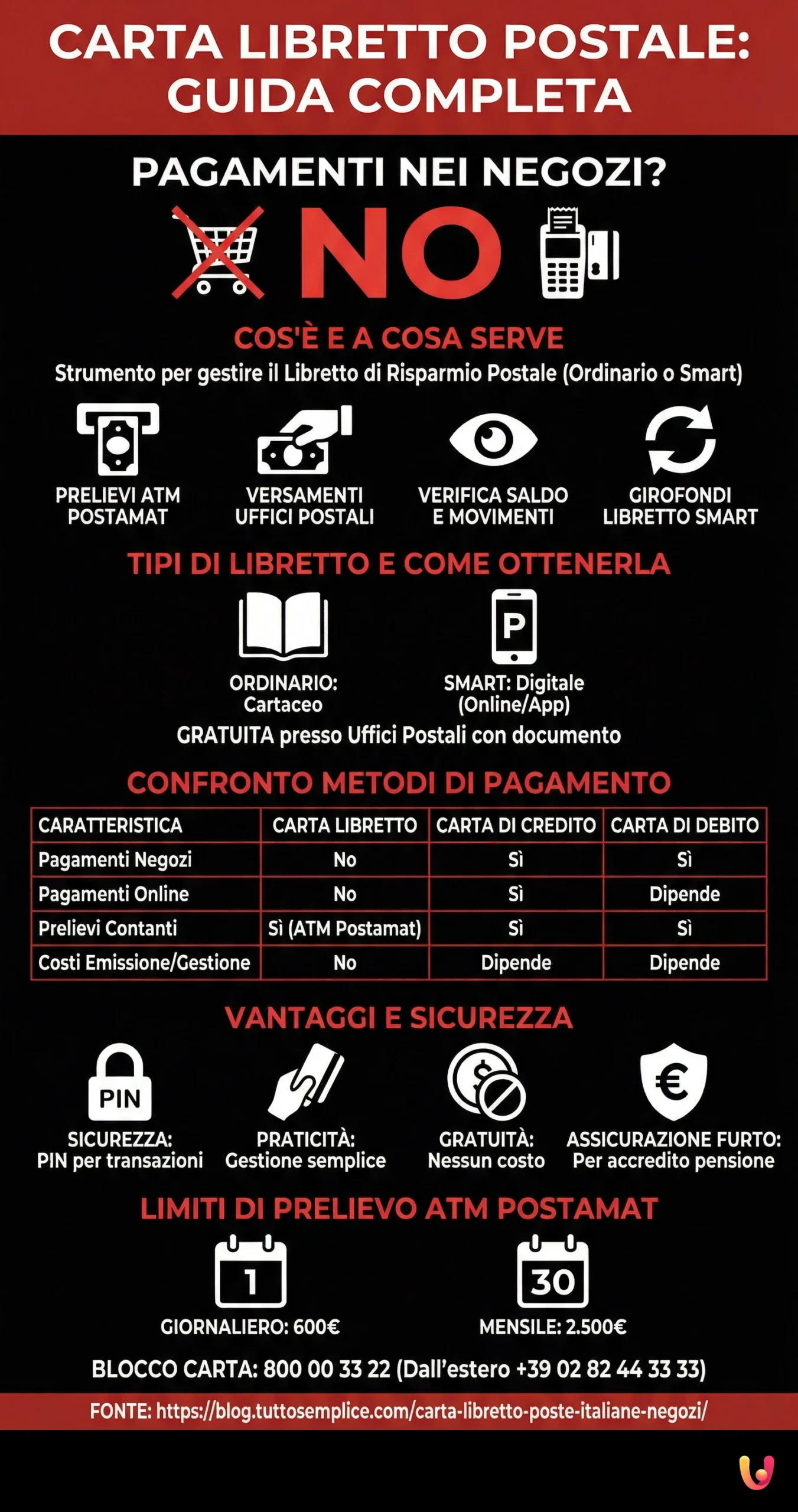

The Postal Passbook Card is a card associated with the Ordinary Passbook or the Smart Passbook of Poste Italiane. Essentially, it is a tool that allows you to access and manage funds deposited in your Savings Book in a practical way.

What is the Postal Passbook Card used for?

With the Postal Passbook Card you can perform various operations:

- Withdraw cash at automatic teller machines (ATMs) Postamat.

- Deposit cash into your Passbook at all post offices.

- Check the balance of your Passbook.

- Check the transaction list of your Passbook.

- Make fund transfers from or to your Smart Passbook.

Types of Postal Passbook

Poste Italiane offers two types of Postal Savings Books:

- Ordinary Passbook: The traditional Passbook, available in paper form.

- Smart Passbook: The digital version of the Passbook, manageable online via the poste.it website or the BancoPosta app.

How to Obtain the Postal Passbook Card

To obtain the Postal Passbook Card, simply go to any post office with a valid ID. The card is free and there are no issuance or management costs.

Deposits into the Passbook

It is possible to deposit even small amounts into the Postal Passbook and the deposited sums are always available.

It is also possible to credit Inps and Inpdap pensions to the Postal Passbook.

Interest on the Passbook

The Ordinary and Smart Registered Passbooks recognize a gross annual yield rate of 0.001%, while the special registered Passbook dedicated to minors recognizes a gross annual rate of 0.01%.

Operations on the Passbook

It is possible to carry out operations on the paper passbook by presenting the document or the Postal Passbook Card. It is allowed to operate on the Passbook issued in dematerialized form exclusively via the Libretto Card.

Postal Passbook Card vs. Other Payment Methods: A Comparison

| Feature | Postal Passbook Card | Credit Card | Debit Card |

|---|---|---|---|

| In-store payments | No | Yes | Yes |

| Online payments | No | Yes | Depends on the card |

| Cash withdrawals | Yes (Postamat ATM) | Yes | Yes |

| Issuance costs | No | Depends on the card | Depends on the card |

| Management costs | No | Depends on the card | Depends on the card |

| Withdrawal limit | Yes (daily and monthly) | Yes (depends on card) | Yes (depends on card) |

Functionality and Benefits of the Postal Passbook Card

The Postal Passbook Card offers several advantages:

- Security: the card is equipped with a PIN that guarantees the security of your transactions.

- Convenience: you can withdraw cash, deposit money, and check your Passbook balance quickly and easily.

- Free of charge: there are no issuance or management costs for the card.

- Free insurance against cash theft: for Passbook holders who credit their pension, free insurance against cash theft is provided.

Can the Postal Passbook Card be used to Pay in Stores?

Unfortunately, the Postal Passbook Card cannot be used to pay in stores. Its main function is to allow withdrawals, deposits, and the management of the Postal Savings Book.

Limits and Restrictions of the Postal Passbook Card

The Postal Passbook Card has some limits, particularly regarding cash withdrawals at Postamat ATMs:

The maximum withdrawal limits from postal automatic teller machines (ATMs) on the Postamat circuit are:

- 600 euros per day

- 2,500 euros per month

Security of the Postal Passbook Card

The Postal Passbook Card is equipped with a PIN that guarantees transaction security. In case of loss or theft of the card, it is possible to block it by calling the toll-free number 800 00 33 22 (from abroad +39 02 82 44 33 33).

In Brief (TL;DR)

The Postal Passbook Card is a free tool for managing the Savings Book.

It is not possible to use the Libretto Card for in-store payments.

The card allows withdrawals at Postamat ATMs with daily and monthly limits.

Conclusions

The Postal Passbook Card presents itself as a useful tool for managing the Postal Savings Book, offering the possibility to withdraw cash, make deposits, and check the balance quickly and easily. However, it is fundamental to understand that its main function is linked to savings management and cannot be considered a substitute for a credit or debit card for daily purchases. The Libretto Card is not enabled for POS payments in physical stores nor for online payments. This limitation makes it less versatile compared to other payment instruments, such as credit and debit cards, which offer greater flexibility for daily transactions.

Despite this, the Postal Passbook Card retains significant advantages, including being free of charge, the security guaranteed by the PIN, and the possibility of crediting pensions. Furthermore, for Passbook holders who credit their pension, free insurance against the theft of cash withdrawn at post offices or Postamat ATMs is provided. Therefore, the Postal Passbook Card can be considered a valid tool for those who wish to manage their savings securely and practically, but it is important to be aware of its limitations and use it in a complementary way to other payment methods for daily expenses.

Frequently Asked Questions

The Postal Passbook Card is used to withdraw cash from Postamat ATMs, deposit cash into the Savings Book at post offices, and to check the balance and transaction list.

With the Libretto Card you can withdraw cash, deposit cash, check the balance and transaction list, and make fund transfers from or to your Smart Passbook.

No, the Postal Passbook Card cannot be used to pay in physical stores or online.

The Postal Passbook Card is free; there are no issuance or management costs.

The maximum daily withdrawal limit is 600 euros, while the maximum monthly limit is 2,500 euros.

If you lose your Postal Passbook Card, you must block it immediately by calling the toll-free number 800 00 33 22 (from abroad +39 02 82 44 33 33) and request a new card at the post office.

Yes, you can withdraw cash with the Postal Passbook Card at automatic teller machines (ATMs) displaying the Postamat logo, even abroad.

You can top up your Postal Passbook by depositing cash at a post office or via bank transfer, if you own a Smart Passbook.

The Postal Passbook Card must be activated at the counter or via a Postamat ATM.

Yes, the Postal Passbook is guaranteed by the Italian State and is considered a safe savings instrument.

Still have doubts about Postal Passbook Card: In-Store Payments? Complete Guide?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.