In the digital age, payment cards have become a natural extension of our financial habits. Italy, in particular, is experiencing a fascinating transition phase: the traditional preference for cash is clashing and merging with an increasingly rapid adoption of innovative solutions. In 2024, for the first time, the value of digital payments surpassed that of cash for Italian household consumption. While this shift offers convenience and speed, it also exposes users to new risks. Understanding the threats and adopting the right countermeasures is essential to navigate this landscape safely, protecting your assets from increasingly skilled and technologically advanced fraudsters.

This manual was created to provide every user, regardless of age or profession, with practical tools for effective digital self-defense. From the basic rules for managing credentials to the most advanced technologies, we will explore strategies to make daily transactions more secure. The approach combines an awareness of cultural traditions, typical of the Mediterranean context, with the need to embrace innovation critically and knowledgeably. Indeed, payment security depends not only on technology but also on the prudence and knowledge of the person using it. Undertaking this journey means transforming every transaction into a conscious and protected act.

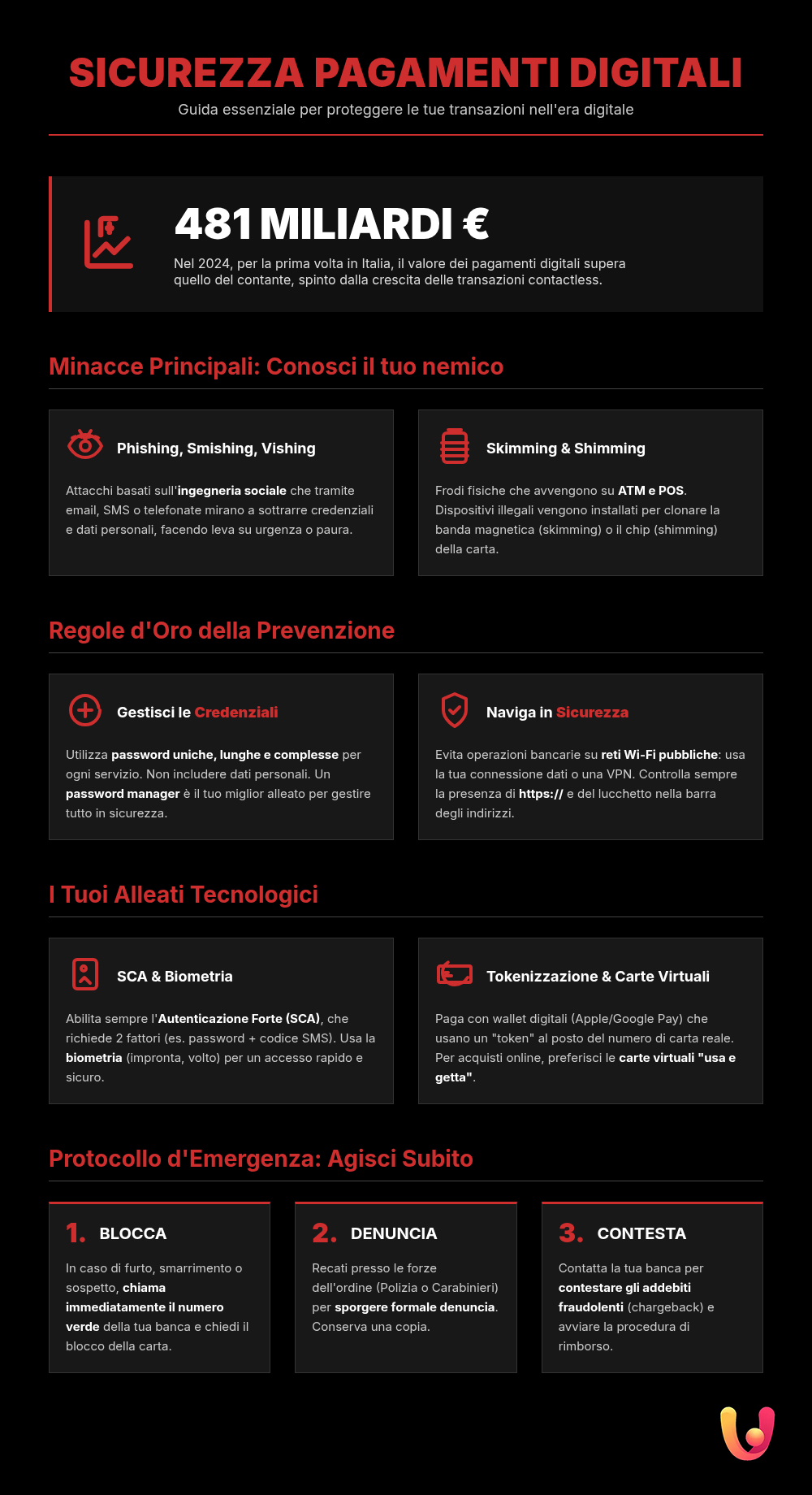

The Payments Landscape in Italy: Tradition and Innovation

The Italian payments market is undergoing an unprecedented transformation, a true bridge between the past and the future. Although Mediterranean culture has historically shown a strong attachment to cash, recent data indicates a clear and consolidated trend reversal. In 2024, the value of digital transactions reached 481 billion euros, an 8.5% increase from the previous year. This overtaking of cash is primarily driven by the popularity of contactless payments, which now account for nearly nine out of ten in-store transactions. This evolution reflects not only a technological but also a cultural shift, with growing trust in tools previously viewed with suspicion.

Innovation doesn’t stop at “tap & go” cards. Solutions like digital wallets on smartphones and wearable devices are seeing exponential growth, with transaction values hitting 56.7 billion euros in 2024, a +53% increase from the previous year. In parallel, phenomena like Buy Now Pay Later (BNPL) are gaining ground, reaching a transaction value of 6.8 billion euros. Despite this rapid digitalization, Italy’s fraud rate remains relatively low, at 0.017% for card transactions according to recent data from the Bank of Italy. However, the growing sophistication of threats requires constant vigilance from users and institutions.

The Most Common Threats: Know Your Enemy to Defend Yourself

To protect your finances, it’s essential to recognize the tactics used by cybercriminals. Fraud can occur with or without the physical presence of the card and often uses social engineering to manipulate victims. Knowing these threats is the first step to avoiding their traps.

Phishing, Smishing, and Vishing: The Deception Triad

Phishing is one of the most widespread scams and involves sending fraudulent emails that mimic communications from banks, public entities, or well-known companies. These emails, often conveying a sense of urgency or threat, push the user to click on malicious links or provide sensitive data like passwords and card numbers. A variation is smishing, which uses SMS as the attack vector, exploiting the speed and reduced attention often given to text messages. Finally, vishing (voice phishing) occurs via phone calls: scammers pose as call center operators or bank officials to deceptively extract information. It is crucial to remember that no legitimate bank or institution will ever ask for sensitive data via email, SMS, or phone.

Skimming and Shimming: Physical Card Cloning

Skimming is a fraud technique that happens in the physical world. Criminals install a device, called a skimmer, over the card slot of an ATM or POS terminal. This device can read and copy the data stored on the card’s magnetic stripe. Often, the attack is completed with a hidden micro-camera or a fake keypad placed over the original one to record the PIN. A more advanced version is shimming, which aims to steal data from the card’s chip. Before using an ATM, it’s good practice to visually inspect the slot for any anomalies, loose parts, or elements that seem out of place.

The Golden Rules of Digital Prevention

The security of our digital payments depends not just on complex technologies, but on a set of good habits that each of us can adopt. Creating a solid defensive barrier starts with simple but fundamental actions. Careful password management, protection of the devices we use daily, and mindful browsing are the pillars of true digital hygiene, essential for keeping our finances safe in the connected ecosystem.

Password and Credential Management

The first line of defense for our accounts is a strong password. It is crucial to use unique and complex passwords for each online service, especially financial ones. A good password should combine uppercase and lowercase letters, numbers, and symbols, and be at least 12-16 characters long. Avoid using easily guessable personal information like birth dates or names. To avoid having to memorize them all, you can use a password manager, a software that securely generates and stores all your credentials. Furthermore, it is essential never to share your PIN and passwords with anyone and to be wary of anyone who asks for them, as your bank will never do so. If you want to learn more, you can read our anti-hacker guide for online account passwords.

Device Protection and Secure Browsing

Our smartphones and computers are the gateways to our money. It is therefore essential to protect them with constantly updated antivirus and antimalware software. Pay special attention to public Wi-Fi networks, which are often insecure. When connecting to an open network in airports, hotels, or cafes, it is highly inadvisable to perform banking transactions or make purchases. Criminals can easily intercept data transmitted over these networks. For greater security, it is preferable to use your mobile data connection or a VPN (Virtual Private Network), which encrypts traffic, making it unreadable to third parties. When browsing, always ensure the site’s address begins with https:// and that a padlock icon is present, indicating a secure connection.

Your Tech Allies for Ironclad Payments

Technology is not only a source of risk but also offers powerful defense tools. Innovation in the payments sector has introduced advanced security mechanisms that, when used correctly, can drastically reduce the likelihood of falling victim to fraud. From multi-factor authentication to virtual cards, these technological allies transform our transactions into ironclad operations, adding layers of protection that make life much more difficult for malicious actors.

Strong Customer Authentication (SCA) and Biometrics

Strong Customer Authentication (SCA), introduced by the European PSD2 directive, is now a pillar of security for online payments. This procedure requires you to verify your identity using at least two of three possible elements: something you know (like a password or PIN), something you have (like the smartphone where you receive an OTP code), and something you are (like a fingerprint or facial recognition). Biometrics, in particular, are becoming increasingly common, offering a fast and very secure authentication method, as explained in our guide on how to say goodbye to your PIN with secure face and fingerprint payments. The adoption of SCA has been proven to effectively contain risk levels in transactions.

Tokenization and Virtual Cards

Tokenization is a technology that enhances payment security by replacing the actual card number with a “token,” a unique digital code. When you pay with a digital wallet like Apple Pay or Google Pay, your card number is not transmitted to the merchant, only this token. In the event of a merchant data breach, your real information remains safe. Virtual cards, often offered by banks via apps, work similarly. They can be “single-use,” valid for just one transaction, or temporary, with a limited spending limit and expiration date. This tool is ideal for online purchases on unfamiliar sites, as it minimizes risk if data is compromised. Learn more about how single-use virtual cards say goodbye to online fraud.

Emergency Protocol: What to Do When Problems Arise

Despite all precautions, your card may be stolen, lost, or cloned. In these situations, timeliness is everything. Acting quickly and following a precise procedure can limit the damage and increase the chances of recovering stolen funds. It’s crucial not to panic and to follow clear, defined steps to secure your accounts and initiate the necessary reporting and reimbursement processes.

Immediately Blocking the Card and Filing a Report

The first, absolute priority in case of card theft or loss is to block it immediately. Every banking institution provides a toll-free number (often available 24/7) specifically for this emergency. Save this number in your phone’s contacts to have it always at hand. Once the card is blocked, no further unauthorized transactions can be made. The next step is to file a report with law enforcement authorities (Police or Carabinieri). This step is not just a formality: a copy of the report is an essential document for disputing fraudulent charges and requesting a refund from your bank. For a detailed guide, you can consult our article on a stolen or lost card: a guide to blocking and reporting.

Disputing Charges and Chargebacks

After blocking the card and filing a report, contact your bank to dispute the fraudulent transactions. The law provides specific protections for consumers who are victims of fraud, which in many cases entitle them to a refund. There is also a procedure called a chargeback (or reversal), which allows you to get a refund for a transaction even in cases of goods not received, defective items, or services not rendered, provided the payment was made with a card. This request must be submitted within specific timeframes, usually between 60 and 120 days from the charge, depending on the payment network. The chargeback is a very powerful consumer protection tool, managed directly by credit card networks like Visa and Mastercard.

In Brief (TL;DR)

A comprehensive guide that teaches you how to protect your payment cards and manage your digital finances securely, covering every aspect: from choosing passwords to handling emergencies like theft or fraud.

We will delve into security best practices, from protecting your personal data to the actions to take in an emergency.

The guide is completed by a section dedicated to the immediate actions to take in case of loss, theft, or suspicious transactions.

Conclusion

Living in the digital age offers undeniable advantages in terms of convenience and access to services, but it requires a new level of awareness and responsibility. The security of our finances can no longer be delegated solely to banks or protection technologies; it becomes an active task that involves each of us. This manual has offered an overview of threats and defenses, highlighting how knowledge is the first and most powerful weapon at our disposal. From choosing a strong password to recognizing a phishing email, every small action helps build a digital fortress around our savings.

Regulatory developments, like the future European PSD3 directive, will continue to strengthen consumer protections, aiming for greater security and transparency. However, no law can ever replace individual prudence. Embracing the innovation of digital payments, which in Italy is rapidly gaining ground on the tradition of cash, means doing so with open eyes and a critical spirit. Regularly monitoring your statements, using available technological tools, and acting promptly in case of anomalies are the habits that transform a simple user into a mature and protected digital consumer, capable of enjoying the benefits of progress while minimizing its risks.

Frequently Asked Questions

If you notice a charge you don’t recognize, the first thing to do is immediately contact your bank or card issuer to block any future transactions. Next, formally request to dispute the suspicious transaction. Finally, if you suspect fraud, cloning, or theft, it is essential to file a report with the competent authorities, such as the Police or Carabinieri, and send a copy to the financial institution.

A strong password is your first line of defense. To be effective, it must be long (at least 15 characters is ideal), complex, and unique for each site. Avoid personal information like birth dates or names, and don’t use common words or simple sequences like ‘123456’ or ‘password’. A good strategy is to create a *passphrase*, a sentence that’s easy to remember but hard to guess (e.g., “I like to use NordVPN to protect my 1500 euros!”), and turn it into a complex password (e.g., “IltuNVpmp1500€!”). For maximum security, use a password manager to create and store unique access keys and always enable two-factor authentication (2FA) when available.

Using your card on unfamiliar sites requires great caution. Before entering your data, check the seller’s reliability by looking for reviews and opinions from other users. Make sure the payment page is secure: the web address should start with ‘https://’ and there should be a closed padlock icon in the address bar. In general, it is not recommended to save your card details on browsers or e-commerce sites. For purchases on new or little-known portals, the Postal Police recommend preferring more secure payment methods like prepaid cards, which limit your main account’s exposure, or systems that do not directly share card data, like PayPal.

Phishing is an online scam where criminals, posing as trustworthy entities like banks or couriers, send you emails or messages to trick you into revealing sensitive data. To recognize it, watch for signs like a sense of urgency, grammatical errors, generic greetings (e.g., ‘Dear Customer’), and suspicious sender email addresses. The fundamental rule is to never click on links or download attachments from unexpected communications. If you have any doubt, contact the company directly through its official channels, without using the contact information provided in the suspicious message. Remember: no legitimate institution will ever ask for your password or card details via email.

Blocking the card is the first step, but not the only one. The correct procedure involves three key actions. First, promptly contact the card issuer’s toll-free number to request an immediate block, an operation available 24/7. Second, within 48 hours, you must file a report of theft or loss with the Police or Carabinieri. Finally, send a copy of the report to your bank or the institution that issued the card; this document is essential for disputing any fraudulent charges and requesting a refund for the illegally withdrawn funds.

Still have doubts about Secure Cards: A Digital Self-Defense Manual for Payments?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.