How many times have you frantically searched for coins for the parking meter or handled greasy cash at the gas pump? These small daily annoyances are quickly becoming a thing of the past. The advent of contactless payments, via cards, smartphones, and smartwatches, has radically transformed these simple operations, making them faster, more hygienic, and more secure. In an Italy where Mediterranean culture often intertwines with a strong attachment to tradition, digital innovation is making its way, offering practical solutions that improve everyday life. This article is a complete guide to navigating the world of contactless payments for parking and refueling, exploring how this technology is reshaping our habits, striking a balance between modern efficiency and established customs.

We will analyze the data behind this silent revolution, look in detail at how payments work at parking meters and gas pumps, and address the crucial issue of security. The goal is to provide a clear and practical picture, suitable for anyone who wants to simplify their daily life by making the most of new technologies.

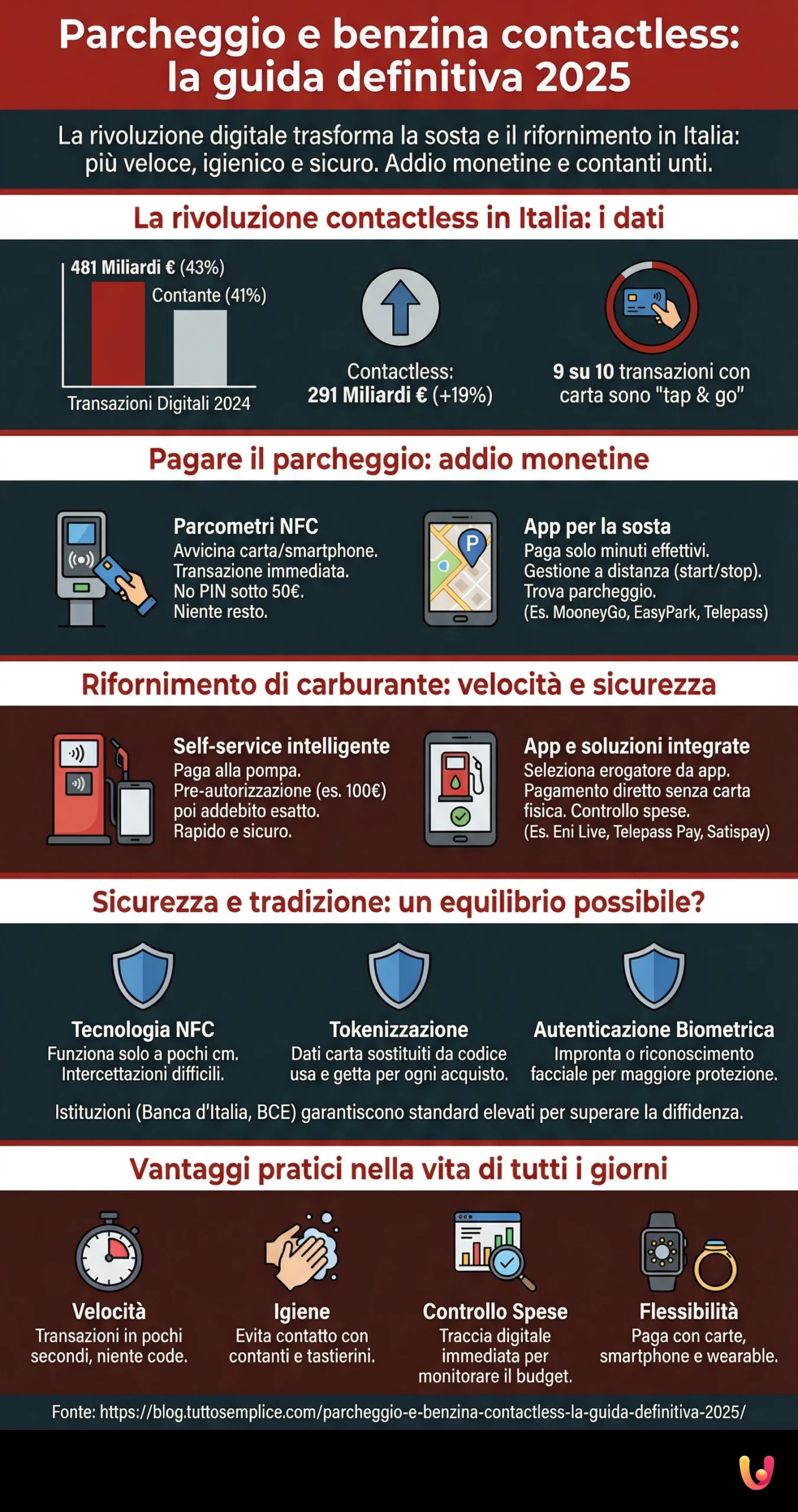

The contactless revolution in Italy: a look at the data

Italy is experiencing an unprecedented digital transformation in the field of payments. Although historically tied to cash, the peninsula has seen an impressive acceleration in the adoption of electronic payment methods. According to the Innovative Payments Observatory of the Politecnico di Milano, 2024 marked a historic overtaking: the value of digital transactions reached 481 billion euros, constituting 43% of total consumption and surpassing cash, stuck at 41%, for the first time. This epochal change is driven primarily by contactless payments, which totaled a whopping 291 billion euros, with a 19% growth compared to the previous year. Today, almost nine out of ten transactions made with a card in a physical store take place in «tap & go» mode.

This trend is not just a matter of numbers but reflects a cultural shift. Convenience, speed, and greater hygiene have won the trust of millions of Italians. Even though the preference for cash remains rooted in a part of the population, the growing spread of POS terminals (3.5 million active terminals) and the integration of payment systems on public transport, as described in our guide on contactless on transport, demonstrate that innovation is becoming an integral part of daily life, creating a bridge between tradition and modernity.

Paying for parking: goodbye coins, hello simplicity

Finding a parking spot is often just the first part of the challenge; the second is paying for it, an operation that for years meant arming oneself with coins and patience. Today, contactless technology has made everything simpler and more immediate. The blue lines, once synonymous with hunting for change, have become fertile ground for digital innovation, offering motorists various quick and intuitive payment methods. From credit cards tapped directly on the parking meter to apps that turn your smartphone into a real parking assistant, the options are numerous and designed to eliminate any complications. Let’s see in detail how these modern solutions work.

How contactless payment works at parking meters

New generation parking meters are almost all equipped with an NFC (Near Field Communication) reader, the same technology that allows «tap & go» payments in stores. The operation is extremely intuitive: just bring your credit, debit, or prepaid card close to the contactless symbol on the device. In a few moments, the transaction is approved. For amounts under 50 euros, entering the PIN code is generally not required, making the operation even faster. This simple action eliminates the need to have the exact amount, insert dozens of coins, or worry about the machine not giving change. It is a solution that combines the physicality of the parking meter with the speed of digital technology.

Parking apps: the parking meter in your pocket

The real revolution for parking payments arrived with smartphone applications. Services like MooneyGo, EasyPark, and Telepass have effectively dematerialized the parking meter, putting it directly in our pockets. These apps offer unparalleled advantages: they allow you to pay only for the actual minutes of parking, with the possibility of stopping or extending the parking remotely, wherever you are. Just select the zone on the map, enter the vehicle license plate, and start the parking session with a tap. Many of these apps also help find parking thanks to intuitive maps. For an in-depth look at mobile payment solutions, you can consult our complete guide to mobile wallets.

Refueling: speed and safety at the pump

The experience of refueling is also changing face, thanks to the widespread adoption of contactless payments at service stations. Waiting at the checkout or using cash at the self-service are giving way to faster and safer systems, which allow you to pay directly at the pump with a card or via smartphone. This evolution not only reduces stopping times but also increases security and control over expenses. The main oil companies in Italy, such as Eni, Q8, IP, and Tamoil, have embraced this innovation, modernizing their infrastructure to offer a service in step with the times.

Self-service becomes smart

Self-service refueling pumps are increasingly equipped with contactless payment terminals. The procedure is simple: you bring the card or smartphone close to the reader, wait for confirmation, and proceed to refuel. An important feature of this system is pre-authorization: at the time of payment, a standard amount (usually around 100-103 euros) is temporarily «blocked» on the card. This serves to guarantee coverage of the cost of the full tank. Once refueling is finished, the blocked amount is immediately replaced with the charge of the exact amount dispensed. It is a standard security measure that guarantees both the user and the operator, making the transaction fluid and smooth.

Apps and integrated solutions for filling up

In addition to direct payment at the pump, there are numerous apps that further simplify the refueling process. Applications like Telepass Pay, Eni Live, or services like Satispay allow you to select the service station and the pump number directly from your smartphone, authorizing the payment in a few seconds without even having to use the physical card. These systems offer an even more integrated and fast user experience. Some, like Telepass, allow you to manage everything, from highway tolls to fuel, within a single platform, offering centralized control of mobility expenses and, sometimes, dedicated promotions and cashback.

Security and tradition: a possible balance?

The adoption of new payment technologies inevitably raises questions about security, especially in a cultural context like the Mediterranean one, where trust in cash is still rooted. However, contactless payments are designed with multiple layers of protection. NFC technology works only at a very close distance (a few centimeters), making remote interceptions almost impossible. Furthermore, for transactions with smartphones, systems like tokenization replace real card data with a «disposable» code (token) for each purchase, protecting sensitive information. Advanced encryption and biometric authentication (fingerprint or facial recognition) add an additional shield. For those who want to learn more, our guide on how data is protected in contactless offers a complete overview.

Overcoming cultural mistrust is a challenge that is won with information and direct experience. The practicality and reliability demonstrated by these systems are gradually convincing even the most skeptical. The role of institutions such as the Bank of Italy and the ECB in ensuring high security standards and promoting adequate financial education is fundamental to accompanying this transition. The balance between traditional prudence and the efficiency of innovation is not only possible, but it is the key to a more inclusive and secure future of payments for everyone.

Practical advantages in everyday life

The integration of contactless payments into the parking and refueling routine brings with it a series of concrete benefits that improve the quality of daily life. The most obvious advantage is speed: transactions take only a few seconds, eliminating queues at the checkout or the search for coins. Another aspect, which has become crucial in recent years, is hygiene, as handling cash or touching keypads is avoided. Furthermore, every digital payment leaves a trace, offering precise and immediate expense control via your bank’s app. This helps monitor the family or business budget much more effectively than cash payments. Finally, flexibility is maximum: you can pay with physical cards, smartphones, and even with wearable devices like NFC rings or bracelets, making the experience even more fluid and futuristic.

In Brief (TL;DR)

Paying for parking and refueling with contactless cards or your smartphone has become the fastest and safest method: discover how to do it in this guide.

Discover step-by-step how to use cards and smartphones to pay for parking in paid zones and self-service refueling, saying goodbye to coins and complications.

Conclusions

Paying for parking and fuel with contactless methods is no longer a vision of the future, but a solid reality of the Italian present. This evolution represents a perfect example of how technological innovation can fit harmoniously into a cultural context rich in traditions, simplifying daily gestures and responding to needs for efficiency, security, and hygiene. The data clearly shows an unstoppable transition towards digital, with contactless leading the way. The available solutions, ranging from «tap & go» cards to multifunction apps, offer flexibility and convenience unthinkable until a few years ago. Although the road to a completely cashless Italy is still ongoing, the direction is set. The balance between Mediterranean prudence and the advantages of modernity is creating a new standard, where the simplicity of a digital gesture frees up time and resources, improving our everyday life.

Frequently Asked Questions

You can pay for parking on blue lines using various smartphone apps such as EasyPark, MooneyGo (which has integrated myCicero), and Telepass. After downloading the app and registering your vehicle and a payment method (credit card, PayPal, etc.), you can start, end, or extend the parking session directly from your phone, paying only for the actual minutes. Remember to display the sticker or tag of the app you are using on the dashboard.

Yes, paying with a smartphone is considered a very secure method. Transactions use NFC (Near Field Communication) technology, which works only at a very short distance (a few centimeters), making data interception difficult. Additionally, your card data is replaced by a unique virtual code for each transaction (tokenization), and the payment must be authorized via biometric recognition (fingerprint or face) or with the device PIN.

Yes, some apps offer integrated mobility services. For example, apps like Telepass Pay allow you not only to pay for parking on blue lines but also for refueling at affiliated service stations, charging the costs directly to your account. This offers greater convenience by bringing together different mobility expenses in a single platform.

When you pay at self-service with a card, a pre-authorization for a maximum amount (usually around 100-101 euros) is requested to guarantee coverage of the cost of the full tank. However, you will only be charged the actual amount of the fuel you dispensed. The difference between the pre-authorized amount and the amount spent will be automatically reversed.

Yes, contactless payments are very widespread and constantly growing both in Italy and in the rest of Europe. In Italy, in 2024, digital payments surpassed cash in terms of value for the first time, and almost 9 out of 10 card transactions in stores take place in contactless mode. Although Italy is still behind Northern European countries in terms of transactions per capita, the growth is very rapid and higher than the average of other large European nations.

Still have doubts about Contactless Parking and Gas: The Ultimate Guide 2025?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.