The transition to a digital society is reshaping our daily habits, including money management. Electronic payments, once considered an alternative, have become the norm in many contexts, with a value in Italy reaching 481 billion euros in 2024. This change, while bringing efficiency and speed, risks creating new forms of exclusion. For seniors and people with disabilities, access to digital financial services is not guaranteed. Technological, cultural, and physical barriers can transform an opportunity into an obstacle, limiting autonomy and participation in economic and social life. It is fundamental that innovation leaves no one behind.

This article explores the topic of digital payment accessibility in the Italian and European context, with particular attention to the Mediterranean culture, where the tradition of cash is still deeply rooted. We will analyze the challenges, emerging technologies such as contactless and biometrics, and regulations aiming to build a more inclusive financial future. The goal is to offer a clear overview, intended for anyone who wants to understand how technology can, and must, be at the service of all citizens, regardless of age or individual abilities.

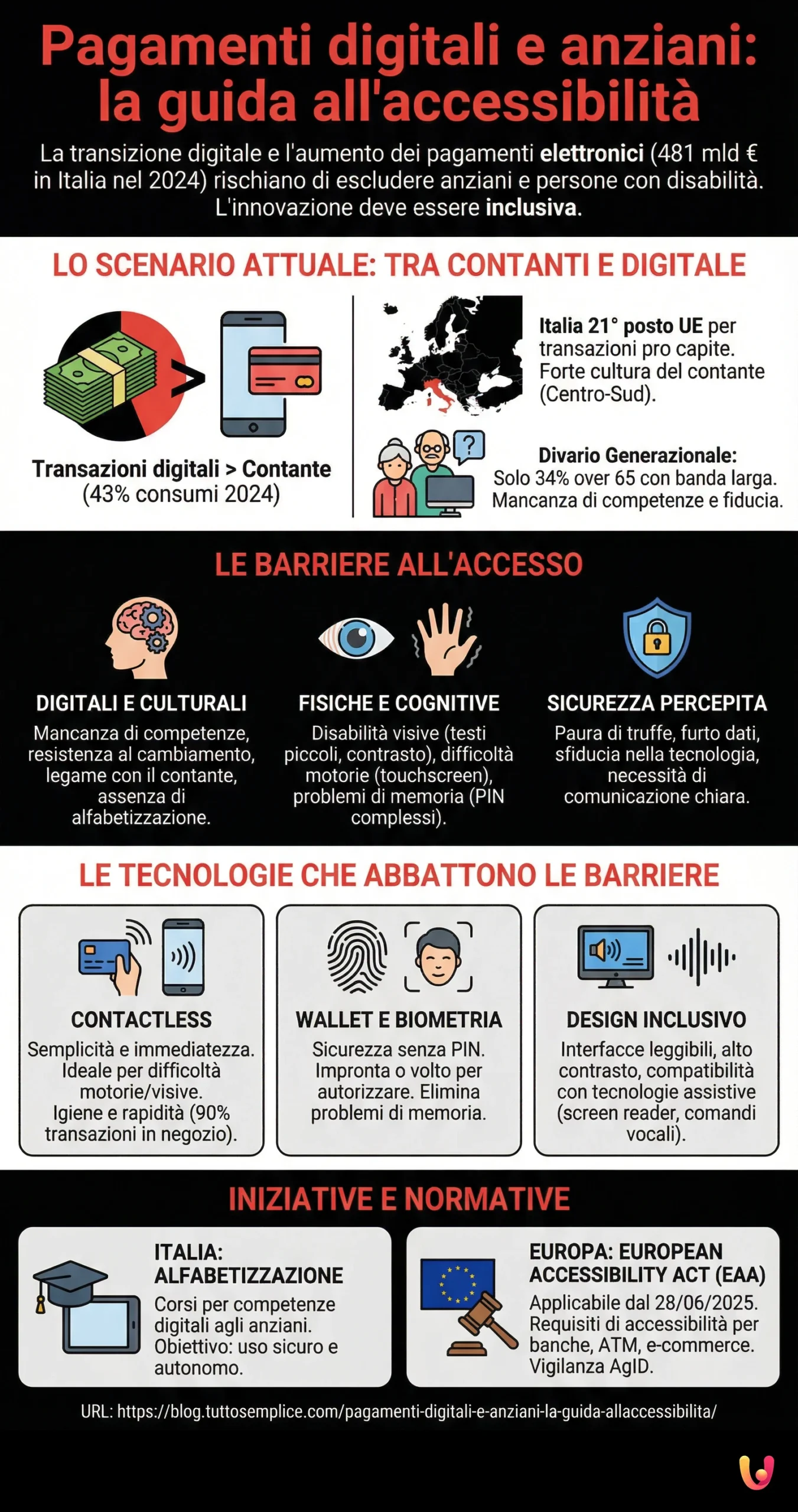

The Current Scenario: Between Cash and Digital

Italy is experiencing a rapid, though uneven, transition towards digital payments. In 2024, for the first time, the value of digital transactions surpassed that of cash, representing 43% of total consumption. Despite this growth, our country still ranks 21st among the 27 EU members for the number of electronic transactions per capita. The culture of cash, especially in the Center-South, remains strong. This phenomenon is linked to traditional factors and a certain mistrust of digital tools. However, the pandemic accelerated a change in habits, pushing more and more people towards cashless solutions. In this scenario, the issue of the digital divide emerges strongly, disproportionately affecting the elderly population.

Statistics highlight a clear generational division. While almost all households with minors have a broadband connection, the percentage drops to 34% for households composed only of people over 65. According to Eurostat data from 2023, almost half of European adults over 65 have never used the Internet. This is not just a problem of access to infrastructure, but also of skills. The lack of familiarity with smartphones and apps, combined with the fear of making mistakes or falling victim to scams, represents a significant brake. Addressing this gap is crucial to ensuring that the benefits of digitalization, such as the convenience and security of electronic payments, are truly universal.

Barriers to Access for Seniors and People with Disabilities

The adoption of digital payments is not the same path for everyone. Seniors and people with disabilities encounter specific obstacles that go beyond the simple lack of technological access. These barriers can be grouped into three main categories: digital and cultural, physical and cognitive, and security-related. Understanding these challenges is the first step to designing truly inclusive solutions capable of responding to the needs of every user and promoting real financial autonomy.

Digital and Cultural Divide

The first major obstacle is the digital divide, a phenomenon that has well-defined contours in Italy. It is not just about not owning a device or an internet connection, but a true cultural marginalization. Many seniors have not had the opportunity to develop the necessary digital skills during their working lives and perceive technology as a complex and distant world. This resistance is often fueled by a strong bond with the tradition of cash, seen as more tangible and controllable. The lack of specific digital literacy programs for the elderly aggravates the situation, leaving many people on the margins of an increasingly interconnected society. It is a question of rights and citizenship, as access to digital services is now crucial for full social participation.

Physical and Cognitive Obstacles

For many people, barriers are concrete and daily. Those with a visual impairment, such as the partially sighted or blind, may find it almost impossible to use apps and websites not designed according to accessibility criteria. Texts that are too small, insufficient color contrast, or the lack of compatibility with screen readers transform a simple operation into an insurmountable challenge. Similarly, people with motor difficulties may have problems handling a smartphone or using a touchscreen with precision. Cognitive challenges, such as difficulty memorizing complex PINs or following articulated procedures, represent a further barrier, not only for the elderly but also for those with learning disabilities.

Perceived and Real Security

The fear of scams is one of the strongest deterrents to the adoption of digital payments. The fear of having one’s card cloned or suffering personal data theft is widespread, especially among those less familiar with technology. This perception, although sometimes disproportionate to the real risks thanks to systems like tokenization, is a powerful psychological factor. News about fraud and cyberattacks contributes to creating a climate of mistrust. It is essential not only to implement robust security systems but also to communicate clearly and simply how they work and what protections are in place for consumers, for example in the case of unauthorized transactions.

Technologies That Break Down Barriers

Fortunately, technological innovation offers concrete solutions to overcome many accessibility barriers. Technologies such as contactless payments, biometrics, and voice interfaces are transforming the payment experience, making it simpler, safer, and more intuitive for everyone. These tools are not just a technical evolution but represent a powerful engine for financial inclusion. Designed with a universal approach, these solutions can make a difference, restoring autonomy and confidence to millions of people. Let’s see which are the most promising and how they are changing our relationship with money.

The Simplicity of Contactless

The contactless technology represented a true revolution due to its immediacy. For small amounts, simply bringing the card, smartphone, or wearable device close to the POS is enough to complete the transaction, without typing any PIN. This simplicity is a huge advantage for those with motor difficulties or vision problems. The absence of physical contact, which became crucial during the pandemic, accelerated its spread, making it appreciated for its hygiene and speed. Today, almost 90% of electronic transactions in stores take place in contactless mode, a testament to how well-designed technology can quickly become a standard appreciated by all.

Digital Wallets and Biometrics: Security at Your Fingertips

Digital wallets, such as Google Pay and Apple Pay, have made paying with a smartphone even simpler and safer. The real turning point, however, is the integration with biometric systems. The use of a fingerprint or facial recognition to authorize a payment eliminates the need to remember PINs and passwords, one of the most felt obstacles by seniors and people with cognitive deficits. Biometrics offers a superior level of security, as physical characteristics are unique and almost impossible to replicate. This combination of convenience and protection is defining the future of payments, as demonstrated by the growing popularity of biometric payments.

Inclusive Design and Assistive Technologies

Technology alone is not enough if it is not supported by inclusive design. App and website interfaces must be designed with all possible users in mind. This means using readable fonts, high color contrast, and ensuring full compatibility with assistive technologies. Tools like screen readers, which read the text on the screen, or voice commands, allow those with visual or motor disabilities to interact with digital services independently. Artificial intelligence is opening new frontiers, for example with the automatic description of images, making the web an increasingly accessible place. Designing for accessibility is not a cost, but an investment that improves the experience for all users.

Initiatives and Regulations: What Is Being Done in Italy and Europe

Financial inclusion is a priority objective at both national and European levels. Institutions have understood that the digital transition must be governed so as not to create new inequalities. In this context, various initiatives have been launched, from training courses to binding regulations, to ensure that digital services are accessible to everyone. In Italy, digital literacy projects aim to provide seniors with the necessary skills to use new technologies safely. At the European level, a fundamental directive is about to change the rules of the game for many companies, imposing stricter accessibility standards.

A key regulation is the European Accessibility Act (EAA), an EU directive that will become fully applicable from June 28, 2025. This law establishes common accessibility requirements for crucial products and services, including banking services, payment terminals like ATMs, smartphones, and e-commerce platforms. The goal is to eliminate digital barriers and create a more inclusive single market. Companies will have to guarantee that their interfaces are navigable by everyone, including through assistive technologies. Supervision in Italy will be entrusted to authorities such as AgID (Agency for Digital Italy), which will be able to impose sanctions in case of non-compliance.

In Brief (TL;DR)

Digital payment technologies, such as contactless and wallets, offer new opportunities for autonomy and financial inclusion for seniors and people with disabilities.

These technologies offer practical solutions to overcome traditional barriers, promoting autonomy and financial inclusion.

We therefore analyze how contactless technologies and digital wallets can simplify money management, promoting greater financial inclusion.

Conclusions

The accessibility of digital payments for seniors and people with disabilities is not just a technical issue, but a social and cultural challenge of primary importance. Digitalization offers enormous opportunities, but the risk of leaving the most fragile segments of the population behind is real. As we have seen, the barriers are manifold: from the skills gap to cultural mistrust, from physical obstacles to fear for security. However, solutions exist and are increasingly effective. Technologies like contactless and biometrics, if combined with inclusive design and simple interfaces, can break down many of these walls, promoting greater autonomy.

The regulatory framework, with the European Accessibility Act at the forefront, is pushing companies to consider accessibility no longer as an option, but as a fundamental requirement. At the same time, digital literacy initiatives are essential to build a culture of trust and competence. The future of payments will inevitably be digital, but its quality will be measured by its ability to truly be for everyone. Innovation, to be such, must walk hand in hand with inclusion, ensuring that no one is excluded from the benefits of progress.

Frequently Asked Questions

Digital payments offer greater autonomy and security. For a person with motor difficulties, paying contactless or via smartphone eliminates the need to handle cash or insert cards into a POS. Technologies like wearable devices (rings, bracelets) make transactions even simpler and faster. This reduces physical barriers, simplifies daily money management, and fosters greater participation in the digital economy, promoting financial inclusion.

Yes, modern digital payment systems are designed with high security standards. Transactions are protected by advanced encryption and multi-factor authentication systems. Digital wallets, like the IT Wallet in Italy, are integrated with secure identification systems like SPID and CIE. Furthermore, they do not transmit real card data during payment, reducing the risk of fraud. It is still fundamental to adopt good practices, such as using complex passwords and never sharing personal codes.

No, it is not necessary to own the latest smartphone model. For contactless payments via apps (like Google Pay or Apple Pay), a device with NFC (Near Field Communication) technology, present on most smartphones for several years, is sufficient. For banking apps that allow transfers or bill payments, a smartphone or tablet with an internet connection and the ability to install the bank’s app is enough.

The best approach is to be patient and proceed step by step. Start by explaining the practical benefits, such as not having to carry a lot of cash. Show concretely how it works, perhaps making a first payment together. Help them install and configure the banking app or digital wallet on their smartphone, ensuring the interface is simple and has legible fonts. There are also specific services and courses, sometimes called «rent-a-grandson», designed to assist seniors with technology.

Remaining excluded from the digitalization of payments can lead to a form of «digital divide» and financial isolation. Many services, both public and private, are moving online, and not being able to access rapid and digital payments can make daily operations like paying bills, buying tickets, or accessing certain offers more complex. Exclusion can limit personal autonomy and the ability to fully participate in economic and social life, creating new inequalities.

Still have doubts about Digital Payments and Seniors: The Guide to Accessibility?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.